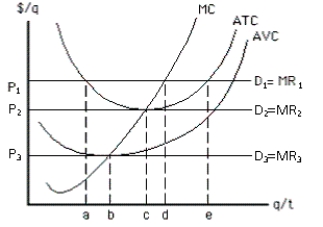

Exhibit 8-6

-At output level a in Exhibit 8-6

Definitions:

CCA Rate

Capital Cost Allowance Rate, which is the percentage rate at which businesses in Canada can claim depreciation on tangible capital assets for tax purposes.

Operating Cash Flow

Measures the cash generated from a company's normal business operations, indicating whether a company can maintain or grow its operations without new financing.

Net Working Capital

The difference between a company's current assets (like cash, inventory, receivables) and its current liabilities (like payables), indicating short-term financial health and operational efficiency.

Cash Flow From Assets

The total amount of money being transferred in and out of a business, particularly from operational, investing, and financing activities.

Q50: If a perfectly competitive firm is producing

Q70: The demand curve a monopolist uses in

Q78: In Exhibit 9-15, deadweight loss to consumers

Q80: For the market shown in Exhibit 8-13,

Q82: For a perfectly competitive firm, marginal revenue

Q161: A monopolist faces an upward-sloping marginal cost

Q170: Cash payments for steel to be used

Q197: For a monopolist, there is no supply

Q198: For firms in an oligopoly to be

Q225: Each member of a cartel<br>A) faces a