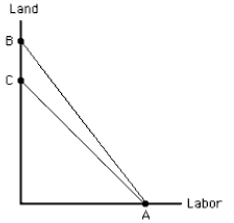

Exhibit 7-18

-Consider Exhibit 7-18. The rotation from AB to AC reflects a(n)

Definitions:

Black-Scholes

A mathematical model used to calculate the theoretical price of European style options based on risk, time, and other factors.

Variance

A statistical measure of the dispersion or spread between numbers in a data set.

Call Option

A financial contract giving the option buyer the right, but not the obligation, to buy a specified quantity of an asset at a set price within a specified time.

Call Option

A finance-related agreement that allows the buyer the choice, yet not the duty, to purchase an equity, debt instrument, commodity, or another type of asset at an agreed-upon price within a set period.

Q18: If a consumer purchases only one good,

Q21: If the supply curve slopes upward and

Q44: In Exhibit 8-14, what area represents variable

Q57: A family on a trip budgets $200

Q90: If every firm is a price taker,

Q97: All combinations of goods along the same

Q105: Within the framework of indifference curve analysis,

Q110: In Exhibit 6-5, the total utility of

Q135: A perfectly competitive firm has a horizontal

Q147: If marginal utility is positive, then total