-Which of the following is true of Exhibit 6-25?

Definitions:

Market Risk Premium

Slope of the Security Market Line; the difference between the expected return on a market portfolio and the risk-free rate.

Cost of Equity

The return a company requires to decide if an investment meets capital return requirements and can finance its operations.

Risk-Free Rate

The return on an investment with zero risk, typically associated with government bonds.

Market Risk Premium

The Market Risk Premium is the additional return an investor expects from holding a risky market portfolio instead of risk-free assets.

Q2: Which of the following is not a

Q27: A firm can increase output by moving

Q52: Which of the following would not appear

Q60: In Exhibit 7-14, what is the average

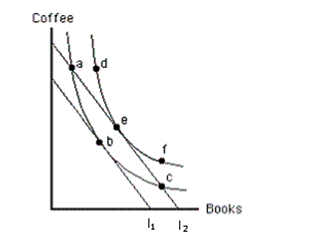

Q61: Suppose Norm really loves coffee and Diane

Q91: At point a in Exhibit 6-11, consumer

Q95: Jennifer learns that the price of CDs

Q115: Time has a positive value for most

Q149: When the price is P in Exhibit

Q221: When demand is elastic, an increase in