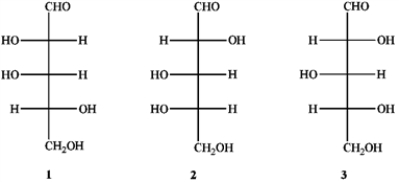

Which of the following has a D-configuration?

Definitions:

Direct Tax

Taxes paid directly to the government by the taxpayer, such as income tax.

Indirect Tax

A tax collected by an intermediary (like a retailer) from the person who bears the ultimate economic burden of the tax (like the consumer). Examples include sales tax and VAT (Value Added Tax).

Fiscal Year

A 12-month period used for accounting purposes and preparing financial statements that may or may not align with the calendar year.

Marginal Tax Rate

The tax rate applied to the last dollar of income earned.

Q2: Propose a structure that is consistent with

Q2: The client is receiving nicotine replacement therapy

Q3: Order: erythromycin 350 mg, PO, q8h.<br>Available: erythromycin

Q6: Which enzymes in the citric acid cycle

Q10: The nurse inadvertently gives the wrong dose

Q12: A client is demonstrating signs and symptoms

Q15: Clinical experimentation occurs in four stages. The

Q19: Which of the following dipeptides is L−Cys−L−Ala?<br>A)<br><img

Q34: The enzyme pyruvate carboxylase<br>A) is not subject

Q34: DNA base sequence with cytosine at the