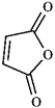

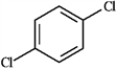

For each of the compounds below tell how many signals you would expect the molecule to have in its normal, broadband decoupled 13C NMR spectra.

-Which of the following would produce only singlets in an 1H NMR spectrum? A  B

B  C

C  D

D

Definitions:

Exercise Price

The exercise price is the price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Standard Deviation

A statistical measure of the dispersion or variability of a set of data points, representing the average difference from the mean; widely used in finance as a measure of investment risk.

Arbitrage Opportunity

The chance to buy an asset at a low price in one market and simultaneously sell it at a higher price in another, securing a risk-free profit.

Long-short Equity Fund

A type of investment fund that takes both long and short positions in stocks, aiming to profit from increases in the prices of some stocks and decreases in the prices of others.

Q1: Guanidine is a fairly strong amine base

Q6: Which of the following has a plane

Q7: Consider the following reversible reaction. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6688/.jpg"

Q8: What is the horizontal axis of a

Q8: Treatment of tert-butyl alcohol with hydrogen chloride

Q22: Refer to instructions. Draw arrows on the

Q30: Predict: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6688/.jpg" alt="Predict: " class="answers-bank-image

Q32: Which of the following bonds gives rise

Q36: Which of the following statements best describes

Q96: Sunlight reflecting off ice crystals produces which