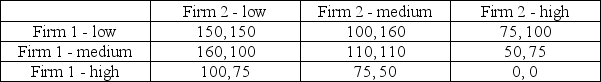

Consider the following output-choice game for two firms:

What is Firm 2's first-mover advantage in a sequential game relative to a simultaneous game?

Definitions:

Capital Budgeting Projects

Capital budgeting projects are long-term investment decisions made by companies to invest in assets and projects for future growth and profitability.

Corporate WACC

Weighted Average Cost of Capital for a corporation, which is the average rate of return it must earn on its investments to maintain the value of its stock and pay its debt.

Expected Returns

The projected average return of an investment over a specified period, accounting for various possible outcomes.

After-Tax Cost of Debt

The net cost of debt to a company after accounting for the tax benefits of interest expenses.

Q9: Refer to Scenario 10.9. At the profit

Q21: A "sequential game" is<br>A) another term for

Q27: When 1983 is the CPI base year,

Q28: Although firms earn zero profits in the

Q83: After the imposition of a tax of

Q83: If the payment stream of a bond

Q105: If the U.S. government retires the national

Q112: Consider the Battle of the Sexes game:<br><img

Q113: In the competitive output market for good

Q152: Refer to Scenario 10.3. What level of