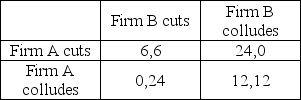

Consider the following payoff matrix for a game in which two firms attempt to collude under the Bertrand model:

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut) . The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

Definitions:

Proactive

Taking initiative by acting in advance of future situations rather than just reacting to events as they happen.

Performance Evaluation Interview

A formal discussion between an employee and their supervisor where the employee's job performance is reviewed, feedback is provided, and development goals are set.

Tell-And-Sell

A communication approach where information is explained (tell) and then the audience is persuaded of its benefits or necessity (sell).

Communicative Peers

Colleagues who actively engage in sharing information, feedback, and support, facilitating open and effective workplace communication.

Q7: American depository receipts pay dividends in dollars

Q13: The variance of foreign stock returns to

Q31: The oligopoly model that predicts that oligopoly

Q33: Your family operates Voltaire's Pizza, which ships

Q34: Which of the following is NOT true

Q59: A lower east-side cinema charges $3.00 per

Q74: The game in Scenario 13.8 is<br>A) variable-sum.<br>B)

Q95: Which of the following situations is likely

Q111: Refer to Scenario 12.3. What will be

Q122: If a monopolist's profits were taxed away