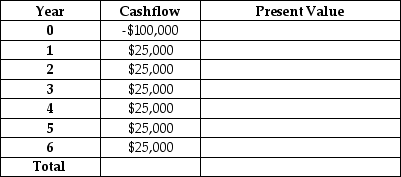

Ed's Electronic Devices has an asset beta of 0.6. The market rate of return is 12% and the risk-free rate of return is 2%. Ed is considering updating his production technology. If he does so, he expects the cash streams indicated in the table below. Given this information, should Ed update his production technology?

Definitions:

Q2: Due to externalities generated by home landscaping,

Q16: A point lying beyond the utilities possibilities

Q22: As firms' expected profit from new capital

Q40: The strategy that worked best in Axelrod's

Q53: Refer to Scenario 18.1. Which of the

Q57: If grades are to be a successful

Q66: Firms that issue callable bonds have the

Q69: Suppose MRS is not the same across

Q80: Refer to Figure 18.2.2 above. Which of

Q110: A plastics factory emits water pollutants into