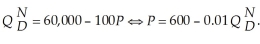

There are two types of consumers of X-box video game systems. The first type of consumer is highly eager to purchase the newest game systems. Their demand is  The resulting marginal revenue function is

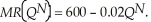

The resulting marginal revenue function is  After the first month the X-box systems are on the market, the first-type demand goes to zero at any price. The second type of consumer is more sensitive to price and will be the same one month after the systems are on the market. Their demand is

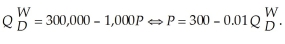

After the first month the X-box systems are on the market, the first-type demand goes to zero at any price. The second type of consumer is more sensitive to price and will be the same one month after the systems are on the market. Their demand is  The resulting marginal revenue function is

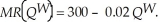

The resulting marginal revenue function is  The marginal cost to the manufacturers is constant at $75. If the X-box manufacturer initially sets the system price at $337.50, calculate their producer surplus. Do any second type customers purchase the X-box system at the initial release? Sometime after the initial release, the manufacturer lowers the price to $187.50. If only the second type of customer purchases the system at this later date, calculate producer surplus from these sales. Why does the X-box manufacturer have an incentive to charge a high relative price at initial release and then lower the price considerably sometime later?

The marginal cost to the manufacturers is constant at $75. If the X-box manufacturer initially sets the system price at $337.50, calculate their producer surplus. Do any second type customers purchase the X-box system at the initial release? Sometime after the initial release, the manufacturer lowers the price to $187.50. If only the second type of customer purchases the system at this later date, calculate producer surplus from these sales. Why does the X-box manufacturer have an incentive to charge a high relative price at initial release and then lower the price considerably sometime later?

Definitions:

Direct Write-off Method

An accounting method where bad debts are expensed only when specific accounts are deemed uncollectible and written off.

Uncollectible Accounts Expense

Uncollectible accounts expense is the cost associated with receivables that a company does not expect to collect, impacting the net income and accurate representation of receivables.

Allowance Method

An accounting technique used to estimate and account for bad debts or credit losses.

Uncollectible Accounts Expense

This refers to the expense recorded by a business to cover debts that are not expected to be collected due to customers being unable to pay.

Q16: Which of the following is true in

Q75: Refer to Figure 9.4.2 above. The amount

Q77: If a competitive firm's marginal cost curve

Q85: Refer to Figure 9.5.2 above. Now suppose

Q87: The benefit of a subsidy accrues mostly

Q92: Marginal profit is negative when:<br>A) marginal revenue

Q95: Refer to Scenario 10.7. Suppose that the

Q96: Cornucopia Media provides cable television service to

Q112: Refer to Scenario 13.17. If the Incumbent

Q146: If a competitive firm's marginal costs always