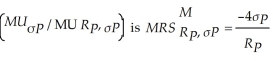

Mel and Christy are co-workers with different risk attitudes. Both have investments in the stock market and hold U.S. Treasury securities (which provide the risk free rate of return). Mel's marginal rate of substitution of return for risk  where

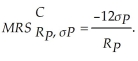

where  is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's

is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's  Each co-worker's budget constraint is

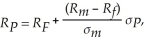

Each co-worker's budget constraint is  where

where  is the risk-free rate of return,

is the risk-free rate of return,  is the stock market rate of return, and

is the stock market rate of return, and  is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of

is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of  ,

,  and

and  .

.

Definitions:

Third-party Logistics Firm

A business that provides outsourced logistics services covering warehousing, transportation, and distribution for other companies.

Supply Management

The process of managing and optimizing the sourcing, procurement, and logistical activities required to obtain products, services, and materials needed by a company.

Organizational Purchasing

The systematic process by which companies buy goods and services they need to operate, considering factors like price, quality, and delivery times.

Closed-loop Supply Chains

Supply chains designed to integrate forward logistics with the reverse logistics process, enabling recycling, refurbishment, or disposal of products.

Q5: Refer to Scenario 5.10. If Hillary invests

Q36: Consider the following statements when answering this

Q38: Based on Figure 3.1.5, it can be

Q57: Why do firms tend to experience decreasing

Q63: Under what conditions will a firm's long-run

Q77: To simplify our consumption models, suppose U.S.

Q86: A supply curve reveals:<br>A) the quantity of

Q115: A freeze in Florida's orange growing regions

Q124: When an industry's raw material costs increase,

Q176: The cost-output elasticity equals 1.4. This implies