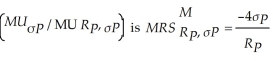

Mel and Christy are co-workers with different risk attitudes. Both have investments in the stock market and hold U.S. Treasury securities (which provide the risk free rate of return). Mel's marginal rate of substitution of return for risk  where

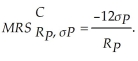

where  is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's

is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's  Each co-worker's budget constraint is

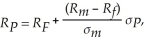

Each co-worker's budget constraint is  where

where  is the risk-free rate of return,

is the risk-free rate of return,  is the stock market rate of return, and

is the stock market rate of return, and  is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of

is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of  ,

,  and

and  .

.

Definitions:

Central Focus

The primary or most important point of attention or activity.

Q23: Refer to Figure 4.1.4 above. The curves

Q48: Which of the following is a positive

Q50: The current market price for good X

Q63: In order to fit linear supply and

Q70: Which of the following statements is true

Q78: Refer to Figure 7.3.1 above. Which point

Q82: When labor usage is at 12 units,

Q138: Refer to Scenario 2.1. What is the

Q168: The total cost (TC) of producing computer

Q176: The cost-output elasticity equals 1.4. This implies