Donna is considering the option of becoming a co-owner in a business. Her investment choices are to hold a risk free asset that has a return of  and co-ownership of the business, which has a rate of return of

and co-ownership of the business, which has a rate of return of  and a level of risk of

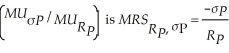

and a level of risk of  . Donna's marginal rate of substitution of return for risk

. Donna's marginal rate of substitution of return for risk  where

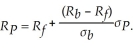

where  is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by

is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by  Solve for Donna's optimal portfolio rate of return and risk as a function of

Solve for Donna's optimal portfolio rate of return and risk as a function of  ,

,  and

and  . Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

. Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

Investment Rate of Return Risk

Risk Free 0.06 0

Business 0.25 0.39

Definitions:

Positive Emotionality

A personality trait that involves the tendency to experience positive emotions, such as happiness and joy, more frequently and intensely.

Eysenck's Model

A psychological theory proposing that personality is determined by the dimensions of extraversion-introversion, neuroticism-stability, and psychoticism-superego function.

Extraversion

A personality trait characterized by outgoingness, sociability, and a high level of engagement with the external world.

Tellegen

A psychologist well-known for his work on personality structure, including the development of the Multidimensional Personality Questionnaire (MPQ).

Q45: From Example 7.2, most pizza restaurants have

Q56: Use the information in Scenario 4.2. Suppose

Q59: The battery packs used in electric and

Q61: If indifference curves cross, then:<br>A) the assumption

Q81: A cubic cost function implies:<br>A) a U-shaped

Q81: A straight-line isoquant:<br>A) is impossible.<br>B) would indicate

Q86: The rate at which one input can

Q91: Refer to Scenario 5.2. Randy's expected expense

Q108: If the law of diminishing returns applies

Q110: The field of behavioral economics has been