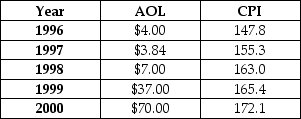

The first column of the following table describes the price movement of AOL Corporation stock over a five-year period. The second column gives the period's consumer price index. Calculate the real value of the stock for each time period using year 5 as the base year. If you purchased $1,000 worth of AOL Corporation in year 1, what has happened to the purchasing power of your original $1,000 investment when you sell the stock in year 5?

Definitions:

Going Concern

The assumption that a company will continue its operations in the foreseeable future and has no intention of liquidating its assets.

Cash Flows from Operating Activities

The section of the cash flow statement that shows the cash generated or used by a company's primary business activities.

Property Plant and Equipment

Long-term assets used in the operations of a business, not intended for sale, including land, buildings, and machinery.

Investing Activities

Financial transactions involving the purchase and sale of long-term assets and investments not included in cash equivalents.

Q3: Typically, organizations performing nonroutine tasks have organic

Q10: Refer to Figure 2.2.2 above. An imposed

Q11: A Rolling Stones song goes: "You can't

Q18: A shoe manufacturer acquires the retail stores

Q25: The area below the demand curve and

Q41: Which of the following statements is true

Q65: Refer to Figure 3.4.1 above. The consumer

Q79: Refer to Figure 4.1.2. From the information

Q90: Informing (by an employee) an outside person

Q131: Using the table below, construct an Engel