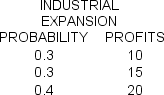

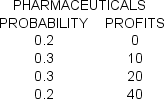

A chemical company is in the process of studying two long-term plans.The first plan involves expansion of their industrial division.The second plan emphasizes expansion in the business of consumer pharmaceuticals.Market research reveals the following (preliminary)results (returns are in $ millions):

The planning committee has the (risk averse)utility function U = 10M - 0.05M2.Discuss the long-term planning decision based on the preliminary predictions and the given utility function:

The planning committee has the (risk averse)utility function U = 10M - 0.05M2.Discuss the long-term planning decision based on the preliminary predictions and the given utility function:

Definitions:

Finance Charges

The cost of borrowing money, including interest and other fees.

Accounts Receivable Turnover

A financial ratio that measures how effectively a company collects cash from its credit sales by comparing net credit sales with the average accounts receivable.

Average Collection Period

The average amount of time it takes for a business to receive payments owed by its customers for goods or services sold on credit.

Net Sales

The total revenue from sales of goods or services, less returns, allowances for damaged or missing goods, and discounts.

Q4: What are the possible actions that the

Q19: Assume that an investor invests $100,000 in

Q21: In the long run,the economic profit earned

Q28: When a chemical firm is required to

Q28: Which of the following is incorrect?<br>A)An auction

Q34: In the lower atmosphere,H2SO4<br>A)is also called black

Q35: A manager recommends selling one of the

Q38: What factors are responsible for buyers and

Q44: Discuss why many agricultural industries in the

Q55: One June 21st,the Sun's declination is at<br>A)the