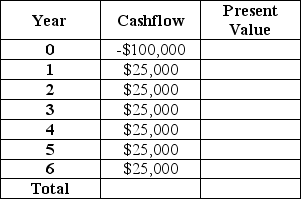

Ed's Electronic Devices has an asset beta of 1.2.The market rate of return is 12% and the risk-free rate of return is 2%.Ed is considering updating his production technology.If he does so,he expects the cash streams indicated in the table below.Given this information,should Ed update his production technology?

Definitions:

Contingency Table

A table used in statistics to display the frequency distribution of variables, helping in analyzing the relationship between different categorical variables.

Frequency of Occurrence

The rate at which a particular event or outcome happens within a specific interval of time or within a given data set.

Chi-square Test for Independence

A statistical method employed to assess if a significant relationship exists between two variables of categorical type.

Degrees of Freedom

The number of independent values or quantities which can be assigned to a statistical distribution, typically defined as the sample size minus the number of parameters estimated.

Q6: A monopolistically competitive firm in short-run equilibrium:<br>A)will

Q8: Assume that a firm is producing at

Q9: The real interest rate is<br>A)the nominal rate

Q43: A market structure in which there is

Q62: On the planet Economus,there are only two

Q66: Refer to Scenario 12.1.What will be the

Q68: Suppose the local market for legal services

Q79: There is always some economic rent whenever<br>A)demand

Q91: Monopoly power results from the ability to<br>A)set

Q94: When new technologies make cleaner production possible,<br>A)emissions