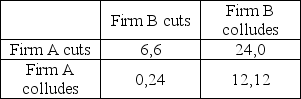

Consider the following payoff matrix for a game in which two firms attempt to collude under the Bertrand model:  Here,the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut) .The payoffs are stated in terms of millions of dollars of profits earned per year.What is the Nash equilibrium for this game?

Here,the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut) .The payoffs are stated in terms of millions of dollars of profits earned per year.What is the Nash equilibrium for this game?

Definitions:

Coupon Bond

A type of bond that offers periodic interest payments to its holder, typically paid semi-annually, until maturity.

Duration

Duration is a measure of the sensitivity of the price of a financial asset to a change in interest rates, often used in the context of bonds to describe how price is affected by changes in rates.

Annual Coupon

The yearly interest payment paid to bondholders, typically expressed as a fixed percentage of the bond's face value.

Maturity

The date on which the principal amount of a financial instrument, such as a bond or loan, becomes due and is repaid to the investor.

Q28: Deadweight loss from monopoly power is expressed

Q28: A country which does not tax cigarettes

Q40: An increase in technology that enhances labor

Q46: The curve in the diagram below is

Q53: Refer to Figure 9.9.At free trade,domestic consumer

Q53: Which of the following is true? Partial

Q63: The marginal revenue product of capital inputs

Q68: The market for an industrial chemical has

Q69: A doctor charges two different prices for

Q110: Refer to Figure 9.3.If the market is