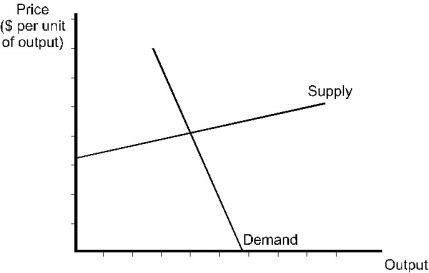

A specific tax will be imposed on a good.The supply and demand curves for the good are shown in the diagram below.Given this information,the burden of the tax:

Definitions:

Short-term Disability Plan

An insurance program that provides employees with a portion of their income for a limited period when they are unable to work due to illness or injury.

Voluntary Benefit

An optional employee benefit, typically self-paid, that offers additional coverage or services beyond the basic compensation package.

Income Security Benefit

Financial assistance provided by government or private entities to individuals, ensuring a minimum level of income for those who are unemployed, disabled, or retired.

Supplemental Unemployment Benefits

Additional financial benefits offered to unemployed individuals that supplement their regular unemployment compensation.

Q51: Use the following statements to answer this

Q57: As the manager of a firm you

Q64: Use the following statements to answer this

Q73: The oligopoly model that is most appropriate

Q102: Consider a good whose own price elasticity

Q103: Consider the following statements when answering this

Q112: An industry has 1000 competitive firms,each producing

Q125: At every output level,a firm's short-run average

Q128: The formula E<sub>s</sub>/(E<sub>s</sub> - E<sub>d</sub>)is used to

Q132: Refer to Figure 9.2.At price 0E and