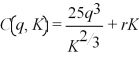

Laura's internet services has the following short-run cost curve:  where q is Laura's output level,K is the number of servers she leases and r is the lease rate of servers.Laura's short-run marginal cost function is:

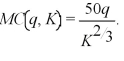

where q is Laura's output level,K is the number of servers she leases and r is the lease rate of servers.Laura's short-run marginal cost function is:  Currently,Laura leases 8 servers,the lease rate of servers is $15,and Laura can sell all the output she produces for $500.Find Laura's short-run profit maximizing level of output.Calculate Laura's profits.If the lease rate of internet servers rise to $20,how does Laura's optimal output and profits change?

Currently,Laura leases 8 servers,the lease rate of servers is $15,and Laura can sell all the output she produces for $500.Find Laura's short-run profit maximizing level of output.Calculate Laura's profits.If the lease rate of internet servers rise to $20,how does Laura's optimal output and profits change?

Definitions:

Child Care Benefits

Employer-provided benefits or subsidies designed to help employees with the costs and logistics of child care.

Family and Medical Leave Act

A U.S. federal law that requires covered employers to provide employees with job-protected and unpaid leave for qualified medical and family reasons.

Liability Concerns

Refers to worries or issues related to the responsibilities and potential legal obligations of individuals or organizations.

Q9: How might department stores best protect themselves

Q40: Refer to Scenario 7.3.What is the total

Q42: George Steinbrenner,the owner of the New York

Q61: Refer to Figure 9.8.In order to eliminate

Q62: An examination of the production isoquants in

Q78: As we move downward along a demand

Q110: If current output is less than the

Q110: Fine-dining restaurants commonly provide statements in their

Q115: Michael's dairy farm's cost function is <img

Q124: The demand for pizzas in the local