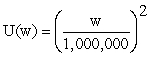

Marsha owns a boat that is harbored on the east coast of the United States.Currently,there is a hurricane that is approaching her harbor.If the hurricane strikes her harbor,her wealth will be diminished by the value of her boat,as it will be destroyed.The value of her boat is $250,000.It would cost Marsha $15,000 to move the boat to a harbor out of the path of the hurricane.Marsha's utility of wealth function is  .

.

Marsha's current wealth is $3 million including the value of the boat.Past evidence has influenced Marsha to believe that the hurricane will likely miss her harbor,and so she plans not to move her boat.Suppose the probability the hurricane will strike Marsha's harbor is 0.7.Calculate Marsha's expected utility given that she will not move her boat.Calculate Marsha's expected utility if she moves her boat.Which of the two options gives Marsha the highest expected utility?

Definitions:

Doodads

A colloquial term often used to refer to non-specific or miscellaneous items, gadgets, or parts without particular naming.

Comparative Advantage

The economic theory that a country should specialize in producing and exporting goods in which it has a lower opportunity cost compared to other countries.

Geegaws

Fancy but ultimately useless objects, often decorative and lacking in practical utility.

Doodads

Informal term for gadgets or small items whose name is either unknown or forgotten.

Q7: Marsha owns a boat that is harbored

Q26: A competitive market is made up of

Q29: The _ depicts the risk-return relationship in

Q47: When the price of wood (which is

Q70: Economic rents are typically counted as:<br>A)accounting costs

Q82: Suppose the table below lists the price

Q86: Sally Henin has a price elasticity of

Q91: From 1970 to 1993,the real price of

Q108: Refer to the indifference curve in Figure

Q116: Refer to Figure 8.1.At the profit-maximizing level