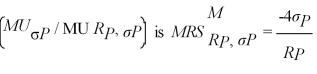

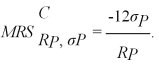

Mel and Christy are co-workers with different risk attitudes.Both have investments in the stock market and hold U.S.Treasury securities (which provide the risk free rate of return).Mel's marginal rate of substitution of return for risk  where RP is the individual's portfolio rate of return and σP is the individual's portfolio risk.Christy's

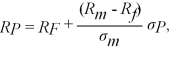

where RP is the individual's portfolio rate of return and σP is the individual's portfolio risk.Christy's  Each co-worker's budget constraint is

Each co-worker's budget constraint is  where Rj is the risk-free rate of return,Rm is the stock market rate of return,and σm is the stock market risk.Solve for each co-worker's optimal portfolio rate of return as a function of Rj,Rm and σm.

where Rj is the risk-free rate of return,Rm is the stock market rate of return,and σm is the stock market risk.Solve for each co-worker's optimal portfolio rate of return as a function of Rj,Rm and σm.

Definitions:

Congressional Elections

The process by which members of the United States Congress (House of Representatives and Senate) are elected by the public.

Liberal Democrats

Liberal Democrats are members of a political ideology or party that emphasizes individual rights, civil liberties, democracy, and typically advocates for progressive policies on social, economic, and environmental issues.

Republicans

A member or supporter of the Republican Party, one of the two major political parties in the United States, traditionally emphasizing limited government, individual freedoms, and free-market policies.

New Deal Democrats

A reference to the followers and supporters of Franklin D. Roosevelt's New Deal programs in the 1930s, advocating for government intervention in the economy to address the Great Depression.

Q7: Complete the following table (round each answer

Q10: Which of the following markets has the

Q10: Your income response for bicycle riding changes

Q11: All of the following <span

Q41: Suppose that the resale of tickets to

Q45: A consumer decides not to buy a

Q64: Acme Container Corporation produces egg cartons that

Q72: A firm's marginal product of labor is

Q88: This year a new oil field with

Q92: Which of the following statements concerning utility