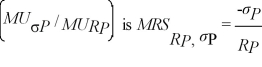

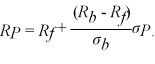

Donna is considering the option of becoming a co-owner in a business.Her investment choices are to hold a risk free asset that has a return of Rj and co-ownership of the business,which has a rate of return of Rb and a level of risk of σb.Donna's marginal rate of substitution of return for risk  where RP is Donna's portfolio rate of return and σP is her optimal portfolio risk.Donna's budget constraint is given by

where RP is Donna's portfolio rate of return and σP is her optimal portfolio risk.Donna's budget constraint is given by

Solve for Donna's optimal portfolio rate of return and risk as a function of Rj, Rb,and σb.Suppose the table below lists the relevant rates of returns and risks.Use this table to determine Donna's optimal rate or return and risk.

Investment Rate of Return Risk

Risk Free 0.06 0

Business 0.25 0.39

Definitions:

Q1: Use the following two statements in answering

Q1: Assume that a firm spends $500 on

Q46: The introduction of refrigerators into American homes:<br>A)decreased

Q53: Use the following two statements to answer

Q54: An upward sloping isoquant<br>A)can be derived from

Q58: Which of the following pairs of goods

Q94: Jim left his previous job as a

Q123: Use the following two statements to answer

Q126: The cost-output elasticity is used to measure:<br>A)economies

Q127: The expected value is a measure of<br>A)risk.<br>B)variability.<br>C)uncertainty.<br>D)central