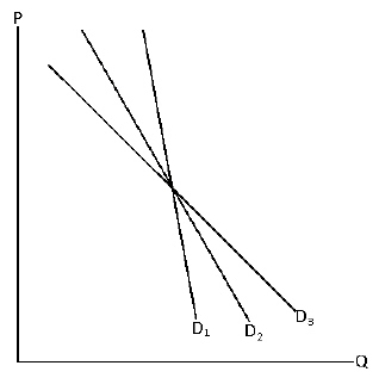

Exhibit 5-17  Consider Exhibit 5-17.Demand curves D1, D2 and D3 represent the demand for food, apples and fruit.Which represents which?

Consider Exhibit 5-17.Demand curves D1, D2 and D3 represent the demand for food, apples and fruit.Which represents which?

Definitions:

Deferred Income Tax Asset

A balance sheet item that represents the difference between taxes already paid or accrued and the expected future tax payment, indicative of taxes that will be recovered in future periods.

Separate Income Tax Returns

Tax documents filed individually by entities or persons instead of jointly or as part of a consolidated group.

Tax Rate

The proportion of income that the government takes as tax from an individual or a company.

Accrual-based Consolidated Net Income

The net income of a consolidated group of companies, calculated using the accrual method of accounting, which records revenues and expenses when they are incurred, regardless of cash movement.

Q7: In calculating price elasticity of demand, which

Q33: Exhibit 6-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6784/.jpg" alt="Exhibit 6-1

Q36: For which of the following would the

Q38: Exhibit 7-6 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6784/.jpg" alt="Exhibit 7-6

Q44: If city officials expect that an increase

Q100: Which of the following causes the supply

Q109: Suppose Toyota produces 100, 000 cars per

Q125: If Ellie Mae spends her income on

Q173: The marginal cost curve intersects the minimum

Q224: Which of the following is not true