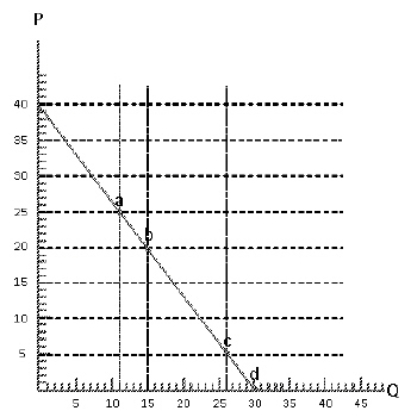

Exhibit 5-28  Use the information in Exhibit 5-28 to calculate the value of price elasticity of demand from point c to d.

Use the information in Exhibit 5-28 to calculate the value of price elasticity of demand from point c to d.

Definitions:

Strike Price

The fixed price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

Call Pays

Call pays refers to the financial transactions or payments made when the issuer exercises a call option on a bond, paying off the principal and any accrued interest before the maturity date.

Protective Put

An investment strategy that involves buying put options on stocks that are already owned to hedge against potential declines in the value of those stocks.

Downside Risk

Refers to the potential loss in value of an investment or asset if the market conditions deteriorate.

Q10: Marginal utility is defined as the<br>A)average amount

Q10: Which of the following is not a

Q21: The term "utility" means<br>A)satisfaction<br>B)a low-valued good<br>C)productivity<br>D)adaptability<br>E)efficiency

Q72: Despite specialization and comparative advantage, household production

Q135: Exhibit 6-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6784/.jpg" alt="Exhibit 6-3

Q150: Which of the following will cause demand

Q157: What is the effect of a reduction

Q170: It has been suggested that if NHL

Q220: Exhibit 4-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6784/.jpg" alt="Exhibit 4-10

Q227: If both demand and supply increase, price