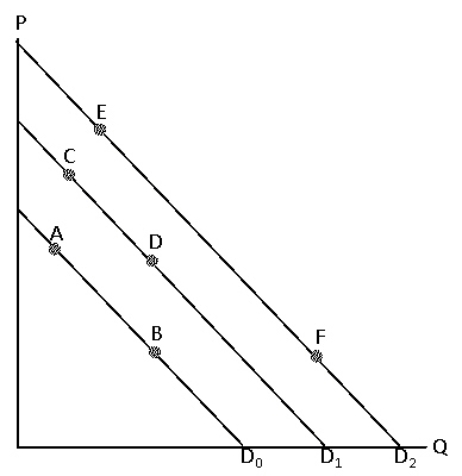

Exhibit 4-1  Consider Exhibit 4-1.Which of the following best represents a decrease in quantity demanded?

Consider Exhibit 4-1.Which of the following best represents a decrease in quantity demanded?

Definitions:

Taxable Income

The portion of an individual's or corporation's income used as the basis for calculating tax owed to the government, after all allowable deductions or exemptions.

Preferred Stock

Preferred stock is a class of shares that typically provides a fixed dividend and has priority over common stock in the event of a liquidation, but generally does not carry voting rights.

Deductible

An amount that can be subtracted from an individual's or organization's taxable income, thereby reducing the amount of tax owed.

Tax Deductible

Refers to a qualifying expense that can reduce an entity's taxable income, and thereby reduce its tax liability.

Q12: Government policies are coercive, whereas markets are

Q28: Exhibit 6-23 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6784/.jpg" alt="Exhibit 6-23

Q32: A normal good is defined as a

Q62: If demand decreases and supply increases, price

Q112: Exhibit 6-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6784/.jpg" alt="Exhibit 6-20

Q117: As producers have more time to adjust

Q136: The demand for flour is<br>A)inelastic because there

Q158: The increased labor force participation of married

Q181: If the supply curve slopes upward and

Q193: Which of the following is the reason