Use the following to answer question:

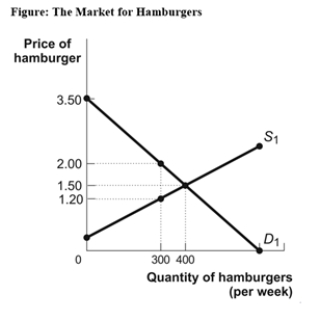

-(Figure: The Market for Hamburgers) Use Figure: The Market for Hamburgers.If the market is originally in equilibrium and the government imposes an excise tax of $0.80 per hamburger,producer surplus will be reduced by:

Definitions:

Marginal Tax Rate

The tax rate applied to the next dollar of taxable income, indicating the percentage of tax paid on any additional dollar earned.

Total Income

The sum of all earnings obtained from work, investments, and other sources before any deductions.

Total Taxes

The combined amount of all taxes levied by a government on individuals, corporations, and other entities.

Tax Rate Structure

The organization of tax rates into different brackets or categories, which determines the amount of tax levied on income, property, sales, etc.

Q5: The belief that importing goods from low-wage

Q18: (Figure: The Marginal Benefit Curve)Use Figure: The

Q21: The purpose of behavioral economics is to

Q44: When the price of chocolate-covered peanuts decreases

Q51: If personal income up to and including

Q85: The _ model analyzes trade under the

Q92: After a price decrease,the quantity effect tends

Q120: To be binding,a price ceiling must be

Q162: Which type of behavior is a systematic

Q285: (Figure: The Market for Music Downloads)Use Figure: