Use the following to answer question:

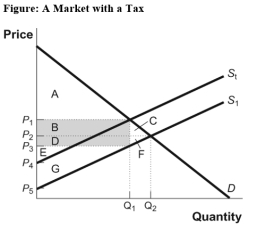

-(Figure: A Market with a Tax) Use Figure: A Market with a Tax.The deadweight loss arising from the imposition of this tax is equal to the areas:

Definitions:

Fixed Costs

Fixed expenses that are unaffected by production or sales volumes, encompassing costs like rent, employee salaries, and insurance fees.

Variable Costs

Costs that change in proportion to the level of production or sales volume, such as raw materials and direct labor.

Break-even Sales

The amount of revenue required to cover both the variable and fixed costs of production, leading to a situation where a business makes neither profit nor loss.

Variable Costs

Costs that vary directly with the level of production output.

Q12: A price ceiling below equilibrium will cause

Q17: The price elasticity of demand is computed

Q45: An excise tax causes a loss in

Q82: If a tax system is designed to

Q99: The benefits principle of taxation means individuals

Q113: In the United States,taxes tend to be

Q192: (Table: Market for Fried Twinkies)Use Table: Market

Q193: (Figure: Rent Controls)Use Figure: Rent Controls.Suppose that

Q223: (Figure: The Market for iPhones)Use Figure: The

Q277: A(n)_ tax tends to encourage consumption and