Use the following to answer question:

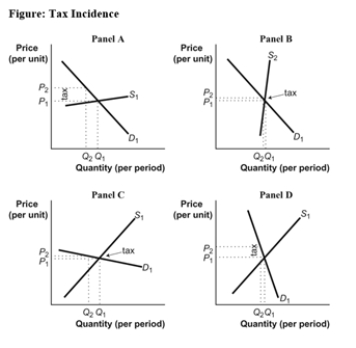

-(Figure: Tax Incidence) Use Figure: Tax Incidence.All other things unchanged,the effect of an excise tax on gasoline in the long run is most likely illustrated by panel _____,and the greater share of the burden of the excise tax (shown by the tax wedge in each panel) is borne by _____.

Definitions:

Cash Disbursements

Payments made in cash or cash equivalents, covering expenses, debts, or other financial obligations.

Direct Labor-Hours

A measure of the amount of time workers spend on a specific task or production process, directly associated with the manufacturing of a product.

Direct Labor Rate

The cost per hour for labor directly involved in the production of goods, not including the cost of materials.

Direct Labor Wage Rate

The rate of pay for employees who are directly involved in manufacturing or producing goods.

Q7: If your purchases of shoes decrease from

Q69: Paying a tax of $20 on an

Q78: (Figure: Supply and Demand)Use Figure: Supply and

Q98: Suppose the cross-price elasticity between two goods

Q117: If the government imposes binding rent control:<br>A)rent

Q134: Price elasticities of demand and supply will

Q159: (Figure: An Excise Tax)Use Figure: An Excise

Q164: (Figure: Supply and Demand in Agriculture)Use Figure:

Q172: A tax system achieves efficiency when it

Q176: A binding price floor in the market