Use the following to answer question:

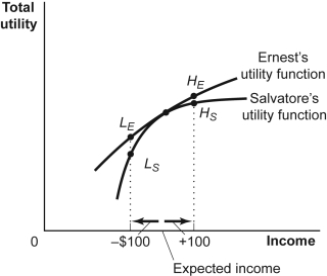

Figure: Differences in Risk Aversion

-(Figure: Differences in Risk Aversion) Use Figure: Differences in Risk Aversion.An important reason that Ernest and Salvatore may differ in their aversion to risk is:

Definitions:

Cost of Capital

The rate of return required by a company to undertake an investment or project, often used as a discount rate in capital budgeting.

Payback Method

A capital budgeting technique that calculates the time required to recoup the cost of an investment, ignoring the time value of money.

MIRRs

Modified Internal Rate of Return (MIRR) is a financial metric used to assess the profitability of investments, adjusting the internal rate of return (IRR) to account for differences in the reinvestment rate and financing costs.

IRRs

Internal Rate of Return; a financial metric used to estimate the profitability of potential investments, calculated as the discount rate that makes the net present value of all cash flows equal to zero.

Q1: If the quantity of housing supplied in

Q6: The point at which the axes of

Q10: The market for milk is initially in

Q67: Which statement describes a principle of the

Q104: When milk consumption decreased,a survey firm wanted

Q120: Which statement is positive?<br>A)The rate of unemployment

Q134: In the factor market,firms buy goods and

Q171: (Figure: The Blu-ray Disc Rental Market)Use Figure:

Q185: Which factor would NOT cause the supply

Q205: Along a given supply curve,an increase in