Use the following to answer question:

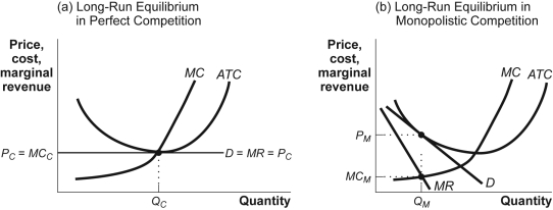

Figure: Comparing Long-Run Equilibriums

-(Figure: Comparing Long-Run Equilibriums) Use Figure: Comparing Long-Run Equilibriums.Which statement is FALSE?

Definitions:

Index Funds

Investment funds that replicate the performance of a specific index of stocks, bonds, or other financial assets.

Expected Opportunity Losses

The anticipated amount of loss associated with not choosing the optimal course of action in decision-making under uncertainty.

Opportunity Loss Table

A tool used in decision-making that outlines the losses associated with not choosing the optimal strategy.

Index Funds

Investment funds designed to replicate the performance of a particular market index.

Q15: Long-run equilibrium in perfect competition and in

Q57: (Table: Externalities from Parks)Use: Table: Externalities from

Q81: Suppose the Alaskan king crab harvest is

Q157: A duopoly is an industry that consists

Q177: One of the earliest actions of antitrust

Q180: A Pigouvian subsidy is:<br>A)designed to discourage activities

Q204: Advertising is an example of:<br>A)tacit collusion.<br>B)nonprice competition.<br>C)antitrust

Q217: (Figure: Profits in Monopolistic Competition)Use Figure: Profits

Q242: A monopolistic competitor will advertise to:<br>A)reduce excess

Q267: Tacit collusion is likely to occur when