Use the following to answer question:

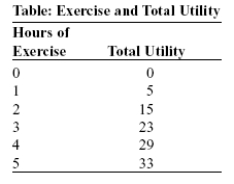

-(Table: Exercise and Total Utility) Use Table: Exercise and Total Utility.The principle of diminishing marginal utility is seen:

Definitions:

Progressive Tax

A tax system where the tax rate increases as the taxable amount or income goes up, making it proportionately higher for wealthier individuals or entities.

Individual Income

The total earnings received by an individual from all sources, including wages, investments, and other forms of compensation.

Marginal Tax Rate

Refers to the rate at which the last dollar of income is taxed, indicating how much tax will be paid on an additional dollar of income.

Tax Payment

The process of paying taxes to governmental authorities, which is obligatory for individuals and businesses.

Q28: Which decision is an example of marginal

Q29: Miguel eats only burgers with onion rings.Miguel's

Q98: The principle of diminishing marginal utility:<br>A)refers to

Q116: (Figure: Game-Day Shirts)Use Figure: Game-Day Shirts.Rick is

Q134: (Figure: Harold's Indifference Curves)Use Figure Harold's Indifference

Q153: You have $1 to spend on a

Q157: A choice made _ is a choice

Q163: (Figure: Long-Run Average Cost)Use Figure: Long-Run Average

Q200: Suppose that some firms in a perfectly

Q306: The total product curve for the Wallmark