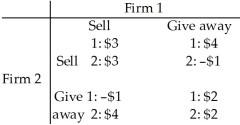

Use the table below to answer the following questions.

Table 14.2.5

-Refer to Table 14.2.5.Two software firms have developed an identical new software application.They are debating whether to give the new application away free and then sell add-ons or sell the application at $30 a copy.The payoff matrix is above and the payoffs are profits in millions of dollars.What is the Nash equilibrium of the game?

Definitions:

Tax Competition

It refers to the phenomenon where countries or jurisdictions compete against each other to attract business through lower tax rates or more favorable tax regimes.

Federal Taxes

Federal taxes are financial charges imposed by a government on individuals, corporations, and other entities' income, property, or transactions to fund public services and obligations.

Regressive

A term referring to a tax system where the tax rate decreases as the amount subject to taxation increases, often disproportionately affecting lower-income individuals.

Value-Added Tax

A consumption tax placed on a product whenever value is added at a stage of production and at the point of retail sale.

Q2: If marginal revenue equals zero,then demand at

Q18: The budget of a government department is

Q45: Refer to Table 14.2.4.The marketers of Budweiser

Q64: Long-run equilibrium occurs in a competitive market

Q68: Homer's Holesome Donuts has determined that its

Q73: For a monopolistically competitive firm to be

Q84: Refer to Figure 12.5.1.Suppose the industry is

Q97: Refer to Figure 15.3.3.The figure shows the

Q100: In 2015,the 20 percent of Canadian households

Q110: Refer to Table 11.1.1 which gives the