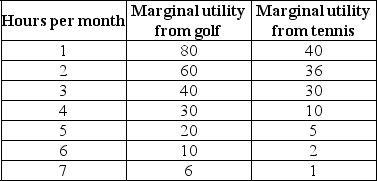

Use the table below to answer the following question.

Table 8.2.5

-Refer to Table 8.2.5.Cindy enjoys golf and tennis.The table shows the marginal utility she gets from each activity. Cindy has $70 a month to spend,and she can spend as much time as she likes on her leisure pursuits.The price of an hour of golf is $10,and the price of an hour of tennis is $5.

Cindy decides to golf for 5 hours a month and play tennis for 4 hours a month.

If Cindy spends a dollar more on golf and a dollar less on tennis,her total utility ________.

If Cindy spends a dollar less on golf and a dollar more on tennis,her total utility ________.

Definitions:

Substitute Goods

Substitute goods are products or services that can be used in place of each other, fulfilling similar needs or desires.

Consumer Income

The total amount of income earned by consumers, impacting their ability to purchase goods and services.

Equilibrium Price

The price at which the quantity of goods demanded is equal to the quantity of goods supplied, leading to a market balance.

Equilibrium Quantity

At the market price, the amount of goods or services available perfectly matches the amount consumers want to buy.

Q3: Complete the following sentence.A price floor set

Q9: If energy (E)is the only input used

Q36: What is a distinguishing characteristic of goods

Q37: When price rises,the substitution effect<br>A)always increases consumption.<br>B)increases

Q40: The magnitude of the slope of the

Q46: Discrimination allocates scarce housing<br>A)to those who are

Q49: Peter's income increases and so does his

Q64: Under a marginal cost pricing rule,a regulated

Q76: Refer to Table 11.2.3 which gives the

Q108: Suppose Swiss Chalet in Moncton knows that