Table 7.2

Table 7.2

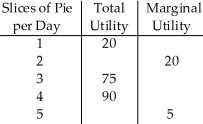

-Refer to Table 7.2.The marginal utility of the fourth slice of pie per day is:

Definitions:

Foreign Taxes Paid

Taxes paid to a foreign government for income earned in that foreign country, which may be creditable or deductible on a U.S. tax return.

Itemized Deduction

Deductions that taxpayers can claim for certain personal expenses, instead of taking a standard deduction. These can include expenses for healthcare, taxes, interest, and gifts to charity.

Foreign Tax Credit

A nonrefundable tax credit for income taxes paid to a foreign government, aimed at reducing double taxation.

Qualified Adoption Expenses

include necessary costs directly related to and for the principal purpose of the legal adoption of a child, which under certain circumstances, can be tax deductible.

Q3: A $2000 tax levied on the maker

Q6: A 44-year-old woman experienced an acute episode

Q16: Table 7.4 shows how the total utility

Q46: As the price of a product rises,the

Q62: The short run can be defined as

Q65: Which of the following is NOT a

Q69: If each firm in a perfectly competitive

Q116: The decoy effect has important implications for

Q123: You are the manager and owner of

Q157: Refer to Figure 5.1.Using the initial-value method,if