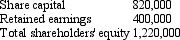

Eagle Ltd is the ultimate parent entity in a group of companies. On 1 July 2003 Eagle Ltd acquired 30 per cent of the issued capital of Sparrow Ltd for a cash consideration of $366,000. At the date of acquisition the net assets of Sparrow Ltd are recorded at fair value and are represented by equity as follows:

Additional information:

During the financial year ending 30 June 2004 Sparrow Ltd makes a profit before tax of $140,000, and an after-tax profit of $89,000.

Sparrow Ltd proposed a dividend of $20,000 for the 2003/2004 period that will be paid early in the next period.

Eagle Ltd does not recognise dividends proposed by associates until they are paid.

During the year ended 30 June 2004 Sparrow made intragroup sales to members of Eagle's economic group. These include:

Sparrow sold inventory to Peregrin Ltd, an 80 per cent owned subsidiary of Eagle Ltd. The inventory cost Sparrow $8,000 and was sold to Peregrin for $12,000. Half of that inventory is still on hand in Peregrin at the end of the period.

Sparrow sold inventory to Seagull Ltd, a 25 per cent owned associate of Eagle's. The inventory cost Sparrow $10,000 and was sold to Seagull for $15,000. Forty per cent of this inventory is still on hand in Seagull at the end of the period.

The tax rate is 30 per cent.

What consolidated journal entry/ies is/are required to equity account for Eagle's interest in Sparrow Ltd for the period ended 30 June 2004?

Definitions:

General Form

A way of expressing a mathematical equation or function in a standard or common manner, often incorporating several variables.

Real Values

Numbers that can be found on the number line including both rational and irrational numbers, but not imaginary numbers.

Quadratic Equation

An equation of the form ax^2 + bx + c = 0, where a, b, and c are constants and a ≠ 0.

Real Solutions

Solutions classified as real are the values which satisfy an equation that belong to the set of real numbers, excluding any imaginary or complex numbers.

Q10: Minority interests are defined is AASB 127

Q18: Which of the following statements is not

Q23: AASB 127 "Consolidated and Separate Financial Statements"

Q26: Flagstaff Ltd has the following potentially diluting

Q33: In the process of consolidating the translated

Q34: Companies A, B and C are all

Q35: The profit or loss on the sale

Q45: Columnar jointing is a characteristic of basalt

Q50: The disclosure requirements of AASB 124 include:<br>A)

Q51: The treatment for breach of going concern