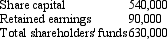

Jay Ltd acquired a 25 per cent interest in Low Ltd on 1 July 2003 for a cash consideration of $177,500. Low Ltd's equity at the time of purchase was as follows:

Additional information:

On 1 July 2003 Low's plant and equipment had a carrying value of $120,000 but a fair value of $140,000. The remaining expected useful life of the plant and equipment at this date was 10 years. Low did not revalue the plant and equipment in its books.

For the period ending 30 June 2004 Low Ltd recorded an after-tax profit of $70,000 out of which dividends of $30,000 were proposed in the 2003/2004 period and paid in the 2004/2005 period.

For the year ended 30 June 2005 Low Ltd had an after-tax profit of $90,000 out of which it provided for a dividend of $40,000, which has not been paid.

Jay Ltd does not accrue the dividends of associates as revenue when they are proposed. The investment has been recorded in Jay's books in accordance with the cost method. What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

Definitions:

Affordable Health Care Act

A U.S. federal statute enacted in 2010 aimed at expanding access to health insurance, reducing health care costs, and improving health care quality.

Subsidized Coverage

Financial assistance provided by government or organizations to help individuals afford health insurance or other forms of necessary insurance.

Penalized

Subjected to a penalty or punishment for an offense or infringement of rules.

Market-based Transactions

Economic activities that occur in a free market, where goods or services are exchanged between buyers and sellers based on demand and supply.

Q11: The following items are in the financial

Q24: AASB 131 disclosure requirements for jointly controlled

Q26: Major volcanic peaks of the Cascade Mountains,

Q35: Intragroup profits are eliminated in consolidation to

Q37: A non-adjusting event is one that:<br>A) Provides

Q38: Exchange differences recognised as borrowing costs and

Q44: Penny Ltd sells inventory items to its

Q52: On acquisition of the investment in associate,

Q53: Tucson Ltd reported basic EPS was $5.70

Q54: In ranking dilutive potential ordinary shares, options