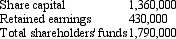

Bee Ltd acquired a 40 per cent interest in Bop Ltd on 1 July 2004 for a cash consideration of $772,000. Bop Ltd's equity at the time of purchase was as follows:

Additional information:

On 1 July 2004 Bop's plant and equipment had a carrying value of $600,000 but a fair value of $650,000. The carrying value of land was $560,000 while the fair value was $600,000. The remaining expected useful life of the plant and equipment at 1 July 2004 was 8 years. Bop did not revalue either asset in its books.

For the period ending 30 June 2004 Bop Ltd recorded an after-tax profit of $470,000 out of which dividends of $60,000 were proposed in the 2004/2005 period and paid in the 2005/2006 period.

For the year ended 30 June 2006 Bop Ltd had an after-tax loss of $60,000. Bop Ltd proposed a dividend of $120,000, which has not been paid this period.

Also during the year ended 30 June 2006, Bop Ltd revalued the land to $610,000.

Bee Ltd accrues dividends of associates as revenue when they are proposed. The investment has been recorded in Bee Ltd's books in accordance with the cost method. What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2006?

Definitions:

Mechanical Ventilation

involves the use of machines to assist or replace spontaneous breathing, critical in patients unable to breathe independently.

Tracheostomy Collar

A device designed to secure a tracheostomy tube in place, ensuring that it remains aligned and does not cause injury to the trachea.

Emergency Response

The immediate and effective actions taken in response to a sudden and urgent situation, often to prevent further harm or damage.

Dislodging

The act of removing or knocking something out of its position, often referring to a foreign object in the body or a component in machinery.

Q3: After eliminating the dividend payable to the

Q17: The North American plate is moving _.<br>A)

Q21: Belgium Ltd owns all the issued capital

Q29: The most common example of a relationship

Q30: In AASB 110 "Events after the Balance

Q34: A _, a mixture of gas and

Q42: Lilo Ltd sells inventory items to its

Q50: Tuff is a rock composed of fine-grained

Q57: There are two broad categories of foreign

Q61: Gigi Ltd is acting as a trustee