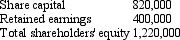

Eagle Ltd is the ultimate parent entity in a group of companies. On 1 July 2003 Eagle Ltd acquired 30 per cent of the issued capital of Sparrow Ltd for a cash consideration of $366,000. At the date of acquisition the net assets of Sparrow Ltd are recorded at fair value and are represented by equity as follows:

Additional information:

During the financial year ending 30 June 2004 Sparrow Ltd makes a profit before tax of $140,000, and an after-tax profit of $89,000.

Sparrow Ltd proposed a dividend of $20,000 for the 2003/2004 period that will be paid early in the next period.

Eagle Ltd does not recognise dividends proposed by associates until they are paid.

During the year ended 30 June 2004 Sparrow made intragroup sales to members of Eagle's economic group. These include:

Sparrow sold inventory to Peregrin Ltd, an 80 per cent owned subsidiary of Eagle Ltd. The inventory cost Sparrow $8,000 and was sold to Peregrin for $12,000. Half of that inventory is still on hand in Peregrin at the end of the period.

Sparrow sold inventory to Seagull Ltd, a 25 per cent owned associate of Eagle's. The inventory cost Sparrow $10,000 and was sold to Seagull for $15,000. Forty per cent of this inventory is still on hand in Seagull at the end of the period.

The tax rate is 30 per cent.

What consolidated journal entry/ies is/are required to equity account for Eagle's interest in Sparrow Ltd for the period ended 30 June 2004?

Definitions:

Par Value

The nominal or face value of a stock or bond as assigned by the issuing company, which may bear no relation to its market value.

Preferred Stock Dividend

Cash distributions that are paid to holders of a company's preferred shares at a specified rate and before dividends are paid to common stockholders.

Earnings Per Common Share

A financial metric used to gauge the profitability of a company on a per-share basis, calculated as net income less dividends on preferred stock divided by the average number of common shares outstanding.

Stock Dividend

A payment made by a corporation to its shareholders in the form of additional shares, rather than cash.

Q1: Which of the following are categories that

Q1: Under AASB 133 an entity is not

Q3: Goodwill arises at acquisition date when the

Q13: Global Reporting Initiative's (GRI) Sustainability Reporting Guidelines

Q14: Firms may make long-term investments in the

Q35: What is the special property of the

Q43: The _ is the most voluminous of

Q49: _ and sapphire are both varieties of

Q53: Tucson Ltd reported basic EPS was $5.70

Q54: Which of the following material after balance