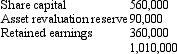

Fish Ltd acquired an 80 per cent interest in Chips Ltd on 1 July 2003 for a cash consideration of $838,000. At that date the fair value of the net assets of Chips Ltd was represented by:

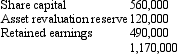

On 30 June 2005 Fish Ltd sold all its shares in Chips Ltd for $950,000. At this date the fair value of the net assets of Chips Ltd was represented by:

The retained earnings of $490,000 includes operating profit after tax of $90,000 from the current period. Impairment of goodwill was assessed at $6,000, the impairment having been incurred evenly across the last two years. The investment has not been marked to market during the period that the shares were held. What is the elimination entry required for the consolidated accounts?

Definitions:

Interest Income

The income earned from lending funds or investing in interest-bearing financial instruments, such as saving accounts, bonds, or loans.

Operating Expenses

Costs associated with the day-to-day operations of a business, excluding costs related to production.

Law of Diminishing Returns

An economic principle stating that as investment in a particular area increases, the rate of profit from that investment, after a certain point, cannot continue to increase if other variables remain at a constant.

Marginal Product

The additional output that is produced by employing one more unit of a particular input, keeping all other inputs constant.

Q4: Which of the following statements is not

Q5: 'Control' exists when the parent owns less

Q10: Igneous rocks may be either _ if

Q11: The following is an extract from the

Q11: Alice Ltd sold inventory items to its

Q21: When equity accounting is applied, how is

Q27: Where a joint venture is a partnership:<br>A)

Q32: The following is an extract from the

Q39: The disclosures AASB 110 requires for a

Q39: The 'spot rate' is:<br>A) The rate for