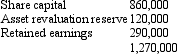

Fan Ltd acquired a 60 per cent interest in Dance Ltd on 1 July 2002 for a cash consideration of $780,000. At that date the fair value of the net assets of Dance Ltd was represented by:

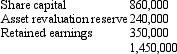

On 30 June 2005 Fan Ltd sold all its shares in Dance Ltd for $880,000. At this date the fair value of the net assets of Dance Ltd was represented by:

The retained earnings of $350,000 include operating profit after tax of $20,000 from the current period. Impairment of goodwill was assessed at $5,400, the impairment having been incurred evenly across the last three years. The investment has not been marked to market during the period that the shares were held. What is the elimination entry required for the consolidated accounts?

Definitions:

Production Expenses

Costs directly incurred in the manufacturing of products or delivery of services.

Scenario Analysis

A process of analyzing possible future events by considering alternative possible outcomes or scenarios.

Project Outcome

The final results or consequences of completing a project, including its success, failure, or any deviations from the original goals.

Range Of Outcomes

The spectrum of possible results or consequences that may arise from a particular decision or action.

Q5: Ramikin Co is a fully owned subsidiary

Q10: As prescribed in AASB 121, in translating

Q11: The translation approach required by AASB 121

Q12: A jointly controlled operation:<br>A) Is a jointly

Q17: Reporting events after balance sheet date is

Q21: A related-party transaction is material if:<br>A) Its

Q25: Sting Ltd and Pink Ltd enter into

Q43: A specific Australian requirement for companies to

Q57: There are two broad categories of foreign

Q62: For a defined contribution plan to satisfy