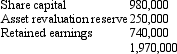

Window Ltd acquired a 70 per cent interest in Door Ltd on 1 July 2003 for a cash consideration of $1,399,000. At that date fair value of the net assets of Door Ltd were represented by:

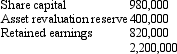

On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000. At this date the fair value of the net assets of Door Ltd were represented by:

Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years. During the period ended 30 June 2005, Door Ltd proposed a dividend of $120,000. The dividend has not been paid at the end of the period, but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed. There were no other intragroup transactions. What are the consolidation entries to eliminate the investment in the subsidiary, account for goodwill and eliminate the dividends for the period ended 30 June 2005?

Definitions:

Tax Advantage

Financial benefits that reduce a taxpayer's monetary burden, often associated with particular investments, savings accounts, or transactions.

Quiet Possession

The guarantee that a tenant can use the rented property without interference from the landlord or other claims against the property.

Registered

A formal process of recording information, typically in an official registry, to ensure legal recognition and protection.

Transfer of Property

The legal process by which the ownership of property is transferred from one party to another.

Q3: In translating the accounts of a foreign

Q8: Rhyolite is considerably more common than granite.

Q9: The following segment information relates to Tolkein

Q13: AASB 121 specifies that post-acquisition movements in

Q21: Milton Friedman expressed the view in his

Q23: After the opening of the North Slope

Q30: A tsunami has a small wave height,

Q46: AASB 133 "Earnings per Share" does not

Q51: The definition of related parties relies on

Q63: To account for financial instruments, there are