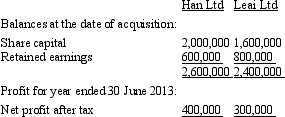

Jabba Ltd acquired a 70 per cent interest in Han Ltd on 30 June 2012 for $2,000,000. On the same date, Han Ltd acquired a 60 per cent interest in Leia Ltd for a cash consideration of $1,600,000. The purchase price represents the fair value of consideration transferred for both investments

The following information is available:

No dividends have been declared since acquisition and there were no intragroup transactions during the year.

What is the non-controlling interest in Han Ltd and Leai Ltd as at 30 June 2013, respectively using the partial goodwill method (round to the nearest dollar) ?

Definitions:

Human Resource Indicator

A metric or measure used to assess and analyze factors related to the management of personnel within an organization.

Stock Price

The cost of purchasing a share of a company as quoted on the stock market, reflecting the market's valuation of the company at a given time.

General Labor Cost

Refers to the total expenses associated with employing labor, including wages, benefits, and other related costs.

Market Share

The portion of a market controlled by a particular company or product, often expressed as a percentage of total sales in a specific market over a given period.

Q3: How equity accounting is implemented is directly

Q12: The amount of a foreign operation's post-acquisition

Q17: AASB 121 requires that the initial recognition

Q28: _ are the smallest electrically neutral assemblies

Q29: The mineral _ is an example of

Q34: Opponents of equity accounting argue that it

Q37: Jabba Ltd acquired a 70 per cent

Q39: The 'spot rate' is:<br>A) The rate for

Q39: Two common approaches to accounting for acquisition

Q49: In the case of non-current investments in