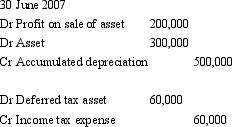

A non-current asset was sold by Subsidiary Limited to Parent Limited on 30 June 2007. The carrying amount of the asset at the time of the sale was $700,000. As part of the consolidation process, the following journal entry was passed.

Assuming there is another ten years of useful life remaining for the asset, what are the journal entries at 30 June 2009 to adjust for depreciation?

Definitions:

Activity Rate

A measurement used in activity-based costing to allocate costs to specific activities, typically expressed as a cost per activity unit.

General Overhead

General overhead encompasses all indirect costs involved in running a business that are not directly tied to a specific product or service, such as utility expenses and salaries of administrative staff.

Unit Selling Price

The amount of money charged to the customer for a single unit of a product or service.

Variable Cost Concept

Costs that vary directly with the level of production output, such as raw materials and labor involved in production.

Q2: Justice Owen in the HIH Royal Commission

Q4: In the process of consolidating the translated

Q6: Events after reporting date should not be

Q9: If expenditures in any of the five

Q10: AASB 8 identifies five factors that are

Q30: In AASB 124 "Related Party Disclosures", two

Q37: The foreign exchange exposure of the parent

Q45: Disclosures required by AASB 110 relating to

Q46: AASB 1023 requires which discount rate to

Q60: An adjusting event is one that:<br>A) Occurred