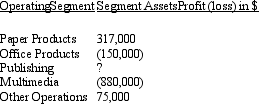

Consider the following list of operating segments and segment results for the current reporting period relating to Legolas Ltd, and answer the question below.

What is the minimum loss (rounded to the nearest $1,000) that the Publishing segment could have made for that segment to be considered a reportable segment according to AASB 8?

Definitions:

After-Tax Discount Rate

The discount rate that has been adjusted to reflect the net of tax status, used in calculating the present value of future cash flows after taxes.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life uniformly.

Net Advantage to Leasing

The total financial benefits of leasing an asset, compared to purchasing it, taking into account all costs and savings.

Lease Payments

Regular payments made by a lessee to a lessor for the use of a leased asset.

Q4: Under the proprietary concept of consolidation, minority

Q29: The profit or loss on the sale

Q32: The disclosure requirements for a defined contribution

Q34: Which of the following is within the

Q36: In determining the existence of 'significant influence',

Q38: The amount of tax assessed by the

Q40: The successful-effort method of accounting for pre-production

Q49: The 'authorisation date' of the financial reports

Q59: After initial recognition, goodwill is measured in

Q62: Ordinary shares are defined by AASB 133