Following are the items of income and expense recognised during the period by Gordon Field LtD.

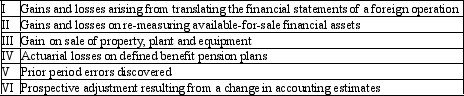

Which of the following combinations identify all items permitted in AASB 101 "Presentation of Financial Statements" to be presented under other comprehensive income?

Definitions:

New Products

Items or services introduced to the market for the first time, aiming to meet consumer demand or open new market opportunities.

Intraoperation Scope

The range or extent of activities and processes conducted within a single operation or phase of production or service delivery.

Supply Chain Surplus

The total value created by the supply chain, computed as the difference between the value of the final product to the consumer and the costs of the supply chain activities.

Implied Demand Uncertainty

The anticipated variation in customer demand, influencing inventory levels, production planning, and capacity decisions.

Q1: When initially recognising the liability and equity

Q12: The superseded version of AASB 1023 required

Q17: The new version of AASB 1023 has

Q32: Claudia Ltd's statement of financial position is

Q33: In general a subsequent event is one

Q44: AASB 119 "Employee Benefits" prescribes that all

Q44: According to AASB 101, the income statement

Q49: Deferred tax assets are the amounts of

Q53: Lease incentives are.<br>A) Not covered by AASB

Q56: A superannuation plan is defined in AAS