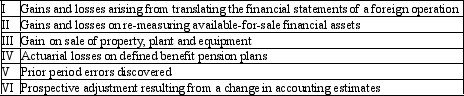

Following are the items of income and expense recognised during the period by Gordon Field LtD.

Which of the following combinations identify all items permitted in AASB 101 "Presentation of Financial Statements" to be presented under other comprehensive income?

Definitions:

Preexisting Knowledge

Information or understanding that an individual already possesses before encountering new information or experiences.

Positive Judgments

Evaluations or opinions formed about someone or something that are favorable or beneficial.

Cognition

The mental action or process of acquiring knowledge and understanding through thought, experience, and the senses.

Emotion

A complex psychological state involving an individual's subjective experience, physiological response, and behavioral expression in response to stimuli.

Q4: The following information relates to Baggins Ltd

Q5: The treatment of deferred acquisition costs is

Q7: Which of the following would not be

Q20: There were two methods of achieving an

Q22: Estimations are frequently made in the income

Q35: Lonsdale Ltd sells mobile phones and provides

Q39: When shares are allotted, or a call

Q41: In the situation where there is an

Q44: AASB 107 requires disclosure of information about

Q48: Jaunty Ltd provides the following information for