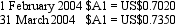

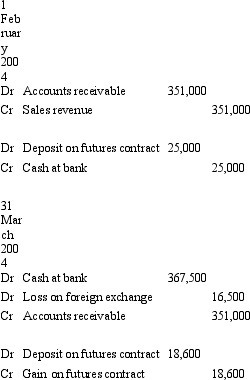

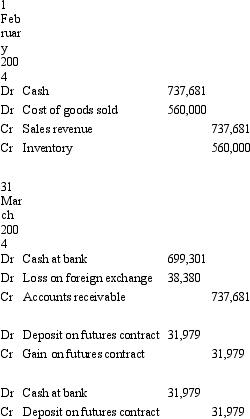

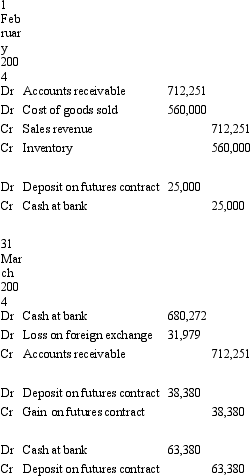

Jackson Ltd has a US$50, 000 receivable due at the end of March 2004 for the sale of a specialised piece of hydraulic equipment. The sale was made on 1 February 2004 and the equipment cost Jackson Ltd $560,000 to manufacture. In order to hedge the receivable, Jackson Ltd enters into a futures contract on that date to sell five US dollar futures contracts. Each contract is for an amount of US$100,000 and the market rate for each futures contract is $A1 = US$0.6778 on 1 February. Jackson pays a deposit of $25,000 on the contracts. The futures contracts are settled on 31 March 2004, when the debtor pays off the receivable. The spot exchange rates during the period were:

The market rate for the futures contracts is $A1 = US$0.7150 on 31 March 2004. What are the entries to record the sale, futures contracts, receipt of payment and the settling of the futures contracts (rounded to the nearest dollar)?

A.

B.

C.

D.

E. None of the given answers.

Definitions:

Securely Attached

Describes individuals, typically infants or young children, who have formed healthy emotional bonds with their caregivers, showing confidence in exploration.

Discipline Technique

Methods and strategies used by parents, guardians, or educators to guide and correct behaviour in children or students.

Inductive

A logical process in which multiple premises, all believed true or found true most of the time, are combined to obtain a specific conclusion.

Independent

The state or quality of being self-reliant and not influenced or controlled by others in terms of one's opinions or conduct.

Q1: Kensington Ltd decides to lease some equipment

Q12: Which of the following statement(s) is/are correct?<br>A)

Q21: Which combination is the appropriate operation to

Q26: The discount rate to be used in

Q35: In accordance with AASB 137 "Provisions, Contingent

Q36: AASB 141 requires that biological asset be

Q39: Which of the following statements is not

Q42: Since the introduction of the tax consolidation

Q55: Which of the following statements is a

Q59: Do-it-Yourself Defined Contribution Plan owns the following