On 31 October 2012 Gordon Investment Ltd has a well diversified portfolio of shares that it is intending to sell in three months time. To hedge against the adverse movements in the price of these shares, the manager obtained four "sell" contracts with DSI Futures. A deposit of $20,000 was required by the broker. A standard futures contract is $25 per basis point.

On 31 January 2013, Gordon Investment Ltd closed out all four contracts.

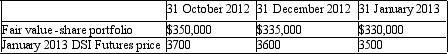

The following information is provided.

What is the fair value of the futures contract on 31 December 2012 and the cash received from DSI futures on 31 January 2013, respectively?

A. ($5 000); $370 000;

B. ($5 000; $40 000;

C. $10 000; $370 000;

D. $10 000; $40 000;

E. None of the given answers

Definitions:

Attendance Record

Documentation or tracking of presence or absence of individuals from events, classes, meetings, or workplaces, often used for administrative, legal, or operational purposes.

Semi-automatic

Refers to a machine or process that requires partial human intervention amongst automated mechanisms.

Idiom

A phrase or expression that has a figurative meaning different from its literal meaning, often cultural in nature.

Speaking Out of Turn

Refers to the act of speaking when it is not one's turn, often considered impolite or disrupting in conversations and meetings.

Q1: Criteria used by an entity to assess

Q1: If a company sells its product but

Q3: The rental payments made during the term

Q9: The following are cash flow transactions for

Q11: Property, plant and equipment that is within

Q16: Under the old AASB 1014 the debt-holder(s)

Q22: Continuously Contemporary Accounting emphasises an entity's ability

Q26: Which of the following statement(s) is/are correct

Q54: Expenditure on an intangible asset that was

Q58: AASB 1023 "General Insurance Contracts" requires premium