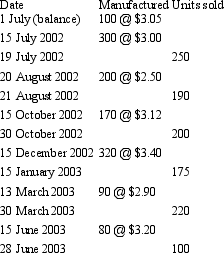

Oblong Ltd manufactures cardboard boxes for a variety of purposes. The following information relates to the production of the extra large packing boxes used by removalists for the period ended 30 June 2003.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

Definitions:

Variable Expenses

Costs that fluctuate with business activity levels, such as raw material costs or utilities following production volumes.

Net Income

The total profit of a company after all expenses, including taxes and operational costs, have been subtracted from total revenue.

CVP Analysis

Short for Cost-Volume-Profit Analysis, a tool used to determine how changes in costs and volume affect a company's operating income and net income.

Contribution Margin Ratio

The ratio of sales income that surpasses variable expenses, showing the extent to which revenue assists in covering fixed costs and generating profit.

Q6: Prior to the introduction of AASB 138

Q6: The requirements of AAS 29 are out

Q6: Two automobiles traveling at right angles to

Q7: As part of the company's compensation plan,

Q9: According to AASB 136 a non-current asset

Q13: Creative Accounting describes the actions of report

Q19: Golden Co Ltd has donated a vehicle

Q25: According to AASB 102 material information relating

Q30: In accordance with AASB 137 "Provisions, Contingent

Q33: AASB 116 permits the following with respect