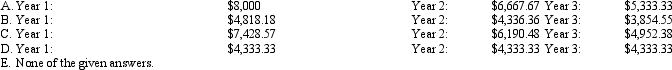

Hugo Ltd has acquired a machine for $26,000 and it cost a further $2,000 to install and set up the machine for operation. It is expected to operate within normal parameters for 6 years. It will be technologically obsolete in 10 years. The expected salvage values are $1,500 after 10 years and $2,000 after 6 years. The benefits to be derived from the machine are expected to be greater in the early years of its life. What depreciation should be charged in each of the first 2 years of the equipment's life using sum-of-digits depreciation?

Definitions:

Chronic Stress

is a condition of continued and persistent stress over an extended period, which can have detrimental effects on one's health and well-being.

Psychoneuroimmunologists

Scientists who study the interactions between the nervous system, psychology, and the immune system, particularly how stress and behavior impact health.

Immune System

A complex network of cells, tissues, and organs that work together to defend the body against attacks by foreign invaders, such as bacteria, viruses, and parasites.

General Adaptation Syndrome

A model that describes the body's short-term and long-term reactions to stress, comprising stages of alarm, resistance, and exhaustion.

Q2: A small car has a head-on collision

Q7: In accordance with AASB 137 "Provisions, Contingent

Q10: What treatment of revenue recognition is required

Q18: Two objects of the same mass move

Q25: AASB 101 indicates that when presenting a

Q27: Two objects having masses m<sub>1</sub> and m<sub>2</sub>

Q29: Intangible assets are not depreciated under AASB

Q31: The following four forces act on a

Q34: The Framework's recognition criteria provides that "an

Q43: Information asymmetry is the situation in which