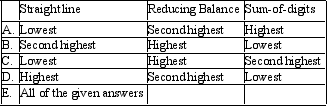

The company has a depreciable asset with a purchase price of $500,000 and an estimated residual of $20,000. The company estimates that the asset will generate future economic benefits for the next 10 years. You are not sure on what depreciation method to adopt but would like to be aware of the effect of using different depreciation methods. Which of the following is correct with respect depreciation expense for Year 1?

Definitions:

Average-cost Method

The average-cost method is an inventory costing method that assigns an average cost to each item in inventory, used to determine the cost of goods sold and ending inventory values.

Weighted-average Cost Method

This inventory costing method assigns a weighted average cost to each unit in inventory, used to calculate cost of goods sold and ending inventory.

Lower-of-cost-or-market

An accounting principle that states assets should be recorded at the lower value of either its cost or its market value.

Specific Identification

An accounting method used to track and assign costs to individual inventory items.

Q9: Which of the following items are not

Q19: Golden Co Ltd has donated a vehicle

Q26: The discount rate to be used in

Q27: How should borrowing costs relating to an

Q32: Seagull Marinas Ltd owns land that was

Q33: Where there is a lease involving a

Q36: What would be the expected radius of

Q38: Which of the following accounting policies is

Q55: Medusa Ltd enters into a non-cancellable 10-year

Q60: A company recently ordered a piece of